Do You Know How To Complete A No Spend January Effortlessly?

Do you have trouble saving money? Perhaps you need to simplify your budget. Here’s how to stop wasteful spending and start saving money. Shopping is something I love to do! In the past few years, online shopping has become my addiction of choice.

The rush, the thrill, and then the crushing regret when I look at my bank account later seems like a cycle.

This cycle shifts to varying degrees throughout the year. There is something I have always struggled with, and now I know one of the reasons WHY I have problems with spending. Hence… this January challenge!

I have ADHD and impulsiveness is part of my brain chemistry. Impulsivity can be a trait of someone who doesn’t have mental health issues, and it is an issue that our society struggles with as a whole.

This is especially true during the holidays. Holiday spending always sneaks up and gets me even when I am trying to save money.

Have you ever felt that way? I know that since I bought a house mid-year, a lot of my money has been going to decorating, etc.

At least that was the justification for my spending habits.

During the holidays the gifts, the food, the wine, the Christmas tree, and decorations add up. Making sure that all our bills are covered (mortgage, utilities, groceries, etc.), plus thinking of everyone on our list for gifts can be a little stressful. But we always manage to make it happen.

This year I’m trying something new and different. I have decided it’s time to make a lifestyle change to break this cycle. I am taking a different approach to bettering myself and my impulsivity.

In conjunction with therapy, I’m committing to an entire month of no-spending in January!

I was asking myself this same question when I stumbled upon this concept online. It means I’m freezing spending on unnecessary purchases this month to build my savings back up.

It’s a whole 30 days or 31 days dedicated to cutting back on unnecessary expenses. Just a heads up, though – paying the bills is still a must! Let’s make frugality fabulous!

I realize that I’m not the only one to come out of the holiday season with less money in the bank.

Most people are unaware of the money that they’re spending regularly. I married an accountant so now I am more in the loop about our finances than ever before.

Goodbye, mindless Amazon app browsing. See you in February, nights out at entertainment or restaurants.

Side note: When I shared I was doing this challenge, my husband lit up like a Christmas tree. He was giddy with joy at the thought of not having to tell me in January to spend less. The entire month of January will be spent using what I have already and purging some things I no longer need or want.

A no-spend challenge is simply a challenge to not spend any extra during a set amount of time.

The most common length of a no-spend challenge is one month but you can also do other periods.

Do you have credit card debt payments? Do you want to build your emergency fund? This is a great way to get started to improve your financial situation.

Doing this type of money challenge allows you to save a lot of money since you won’t be spending like normal. For many people, it can also break bad habits and unconscious spending.

How Would You Prepare for No-Spend January?

Why would anyone do a financial challenge like this? What are the rules for a no-spend challenge? I started with some research at The Savvy Sparrow and Pennies Not Perfection to see how other talented women have approached this challenge.

Well, the good news is this can be whatever you want it to be!

Here are some example rules to not spend extra money during the challenge.

- Stop spending money COMPLETELY for a set period – Obviously, this would require that you have a good stock of food and that any bills that may become due in that time frame have already been paid.

- Stop spending money on non-essential items/impulse buying

- Stop spending money on only one or two categories – For instance, stop spending money on eating out at restaurants for 30 days.

Here is what I will be doing to prepare for my No Spend Month.

- I will be deleting these apps from my phone (to not be tempted by impulse purchases)

- Amazon

- ThredUP

- Athleta

- Fabletics

- Target

- Wayfair

- Thrift Books

- Unsubscribe from ALL newsletters that lead me to shop

- Pausing any recurring payments that aren’t necessities from debiting in January.

- No drinking aka Dry January – so no wine club purchases or alcohol at all.

- No thrifting trips (I will only be working with what I already have and have previously purchased)

- No late-night scrolling on my phone, IG or TikTok

- I am adding a nightly journaling and reading routine to get ready for bed instead of phone time. (I have been using online shopping as an outlet to distract myself from processing certain feelings)

- Adding accountability by sharing that I am doing this and inviting my readers to join me!

How Do You Get Through A No-Spend Month?

You can also use things like gift cards that you received during the holidays if you want to do a night out or in. But for any other non-essentials you want to set boundaries around you must impose a spending freeze.

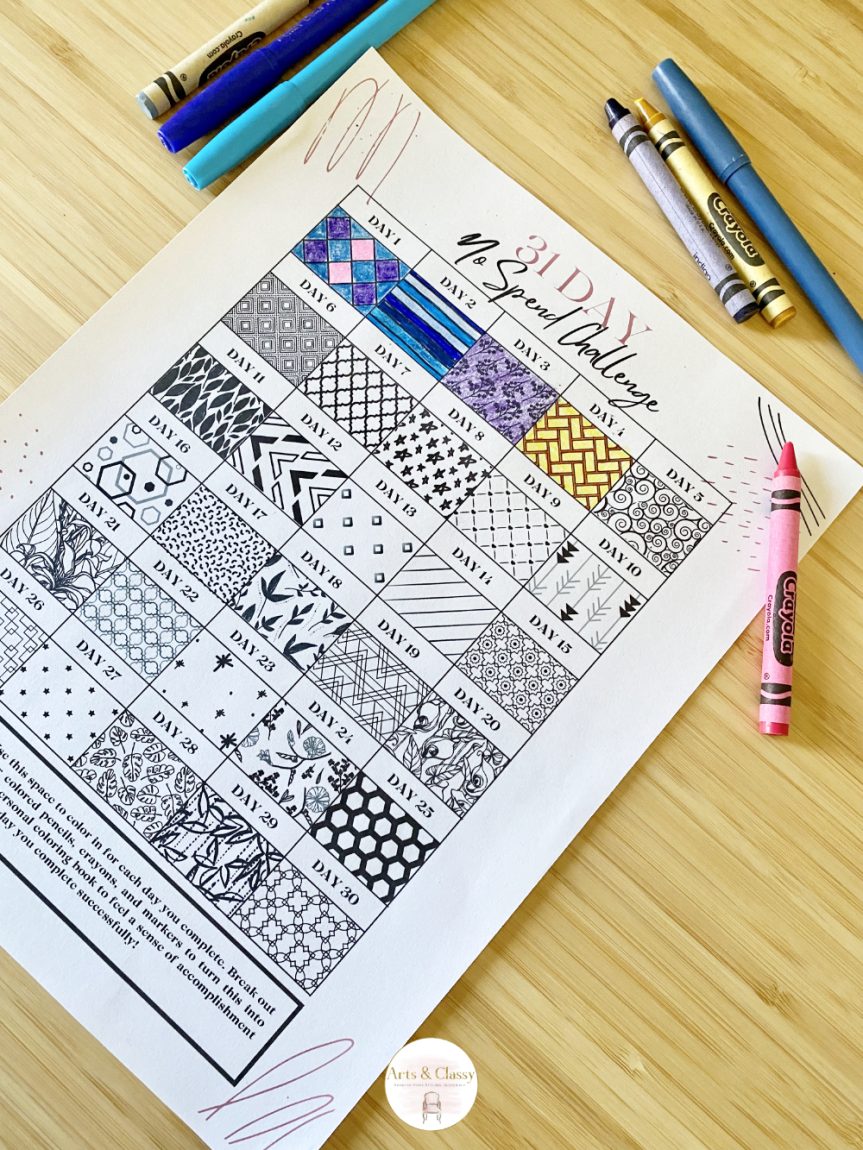

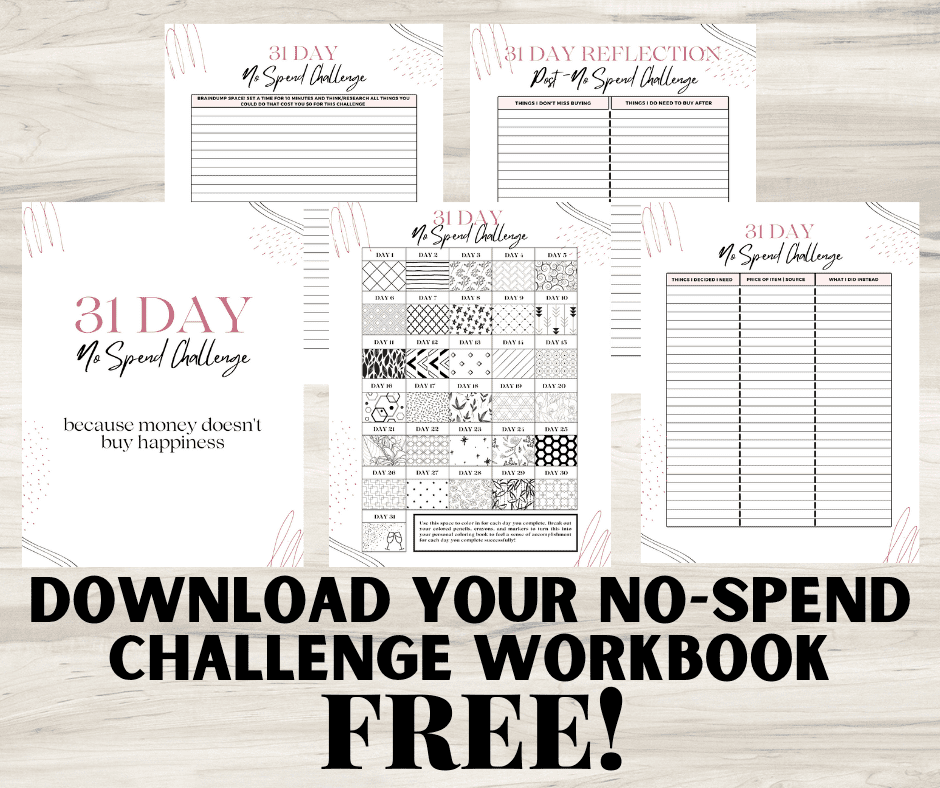

I am not sure about you but my inner child loves printable worksheets and coloring, so I put together my little workbook for this challenge to help me get through it.

I want to share my 5-page workbook with you too! You get it for FREE! If you decide to post to your social media as well, please tag me @artsandclassy.

Track Your Habits

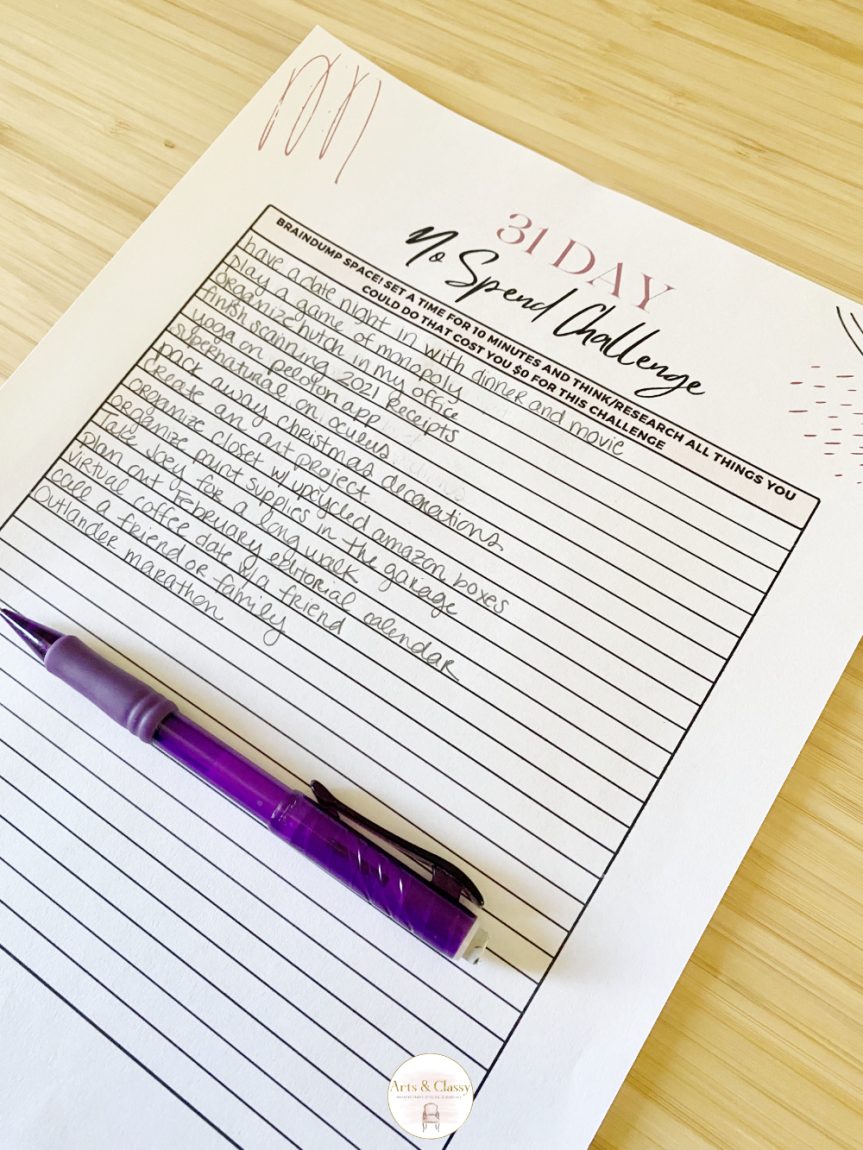

One of the worksheets I am giving away will allow you to brainstorm a lot of ways to spend your time vs spending your money.

I see this as an opportunity to get some things done that have been on the to-do list so by the end of the month I feel a sense of pride for being productive on top of saving money.

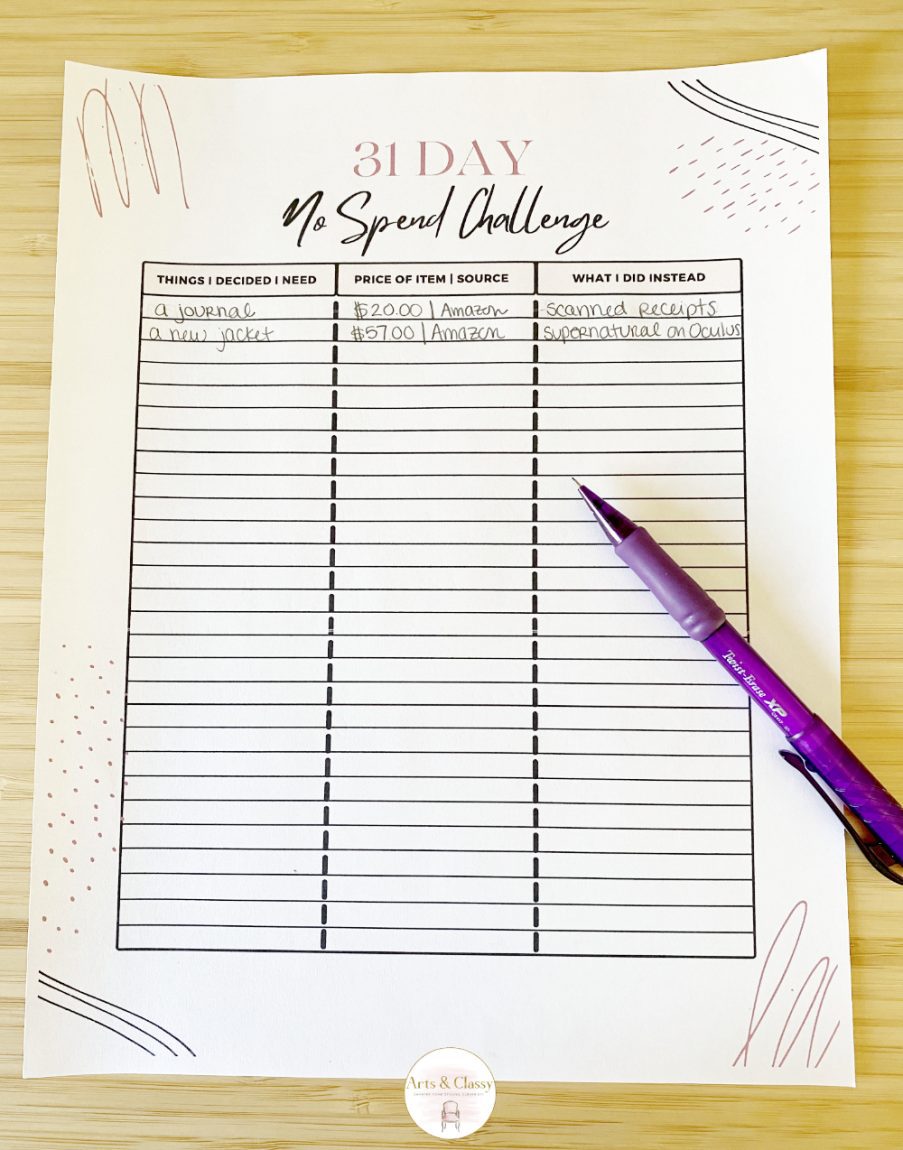

Another worksheet in the bundle is to track your habits. What did I decide I needed? What was the price and where was it? Lastly, what did I do instead of spending?

I am consciously trying to shift my habits while tracking where I am most inclined to spend my hard-earned money.

This will also be a great tool to look back on come to the end of the month to see how much money I saved myself.

Perhaps at the end of the month, I will tally how much money I potentially would have spent and put it in savings or our vacation fund instead.

I haven’t decided how I want to complete this step yet. I will figure it out during the month and so should you!

Stop Impulsive Shopping

I have narrowed down where I am more susceptible to impulsive shopping and it’s scrolling on my phone before bed. It is especially true if I had wine.

This is part of why removing certain apps, unsubscribing from newsletters, and changing up my nightly routine are so important to my success with this challenge.

To stay accountable, I am asking for support from my husband, therapist, and YOU! I will be sharing my progress on my IG stories and talking through moments where I have success and where I struggle.

A way that I plan to reward myself is with my countdown calendar printable which is a mini coloring book. I will color in each day as I complete it without spending money on anything but necessities.

Find Opportunities For Freebies

This is an opportunity to flex the creative muscles and prevent unnecessary spending. I will only be using things I already have OR other free things to use for projects.

For example, I want to organize my closet better in January. I will not be spending money on fancy baskets or organizers.

Instead, I will be using my Amazon boxes to create a system in my closet that is aesthetically pleasing with the fabric and ribbon I already own as my inspiration.

In conclusion, impulse spending can interfere with the quality of life, but it doesn’t have to have power over you accomplishing your financial goals.

My hope and goal with this non-essential spending challenge is to find a better quality of self-care and life. I want to reach my savings goals and buying new clothes multiple times a week (even if it’s thrifted) isn’t the answer. This challenge can shed light on how little purchases add up over time.

Don’t forget to download your FREE 5-page challenge workbook! If you decide to follow along or participate please post to your social media as well, please tag me @artsandclassy.

Until next time A&C fam! Keep it classy!

If you enjoyed this post, you might also like:

![[Dec 8th] FTF: Budget-Friendly Holiday Outfits Steal the Spotlight!](https://www.artsandclassy.com/wp-content/uploads/2023/12/Haute-Edition-Women-s-Heather-Contrast-Slouchy-Cozy-Pocket-Sweatshirt-Tunic_8eca3ad3-9ef9-48bb-98a3-fb3e1eeea578.493e3116b351131e762b5d1aeb1d2fc2.webp)